Financial Debt Purchasing Realty: Opportunities in New York

Financial obligation investing in property has become an eye-catching choice for capitalists seeking stable, passive earnings with lowered exposure to market variations. In New York, a flourishing real estate market, financial obligation investment supplies possibilities for capitalists to make constant returns while mitigating risks connected with home possession.

What is Debt Investing in Realty?

Financial obligation investing includes giving resources to realty designers, homeowner, or buyers for rate of interest repayments. Unlike equity capitalists that possess a share of the property, financial obligation capitalists act as lenders and make returns through repaired rate of interest on car loans.

Benefits of Real Estate Debt Buying New York City

Secure Returns-- Debt financial investments create foreseeable interest revenue, making them a reliable source of easy earnings.

Lower Risk Contrasted to Equity Investments-- Financial debt financiers are prioritized in settlements, meaning they earn money before equity owners in case of defaults.

Diversification Opportunity-- Investors can spread their risk across numerous property jobs, including industrial, residential, and mixed-use buildings.

Hands-Off Financial investment-- Unlike straight residential property ownership, debt investing calls for marginal management and upkeep responsibilities.

Access to High-Value Markets-- New York's solid realty market guarantees demand for financing, allowing capitalists to take part in premium deals.

Sorts Of Real Estate Financial Obligation Investments

1. Private Lending

Financiers offer finances to programmers or property owners, earning rate of interest on the financing amount. Personal lending is common in fix-and-flip jobs and commercial realty bargains.

2. Real Estate Crowdfunding

On the internet platforms enable capitalists to merge funds and money real estate jobs. This supplies accessibility to smaller sized capitalists that want exposure to realty financial debt.

3. Mortgage-Backed Stocks (MBS).

These are financial investment items backed by real estate car loans. Financiers gain returns as property owners or property owners settle their home mortgages.

4. Mezzanine Financial Debt Funding.

A hybrid financial investment that blends financial obligation and equity, mezzanine financings supply greater returns for a little raised threat.

Ideal New York Markets for Real Estate Financial Obligation Investing.

Manhattan-- Deluxe advancements and business residential or commercial properties develop solid financing possibilities.

Brooklyn-- A expanding market for domestic and mixed-use growths.

Queens-- Affordable real estate and new development tasks boost demand for funding.

Upstate New York City-- Emerging real estate possibilities in cities like Albany and Buffalo.

Long Island-- High-value domestic and vacation rental markets provide financial debt financial investment potential.

Obstacles & Considerations.

Market Fluctuations-- While financial debt investing is less unpredictable than equity, financial shifts can affect customer settlement capability.

Governing Compliance-- New york city has stringent lending guidelines, requiring financiers to ensure conformity.

Default Risk-- While structured to lessen risk, some debtors may skip, impacting returns.

Liquidity Problems-- Financial debt investments usually have dealt with terms, limiting fast accessibility to funds.

How to Begin with Real Estate Financial Obligation Buying New York.

Research Study Borrowing Platforms-- Systems like Fundrise, PeerStreet, and CrowdStreet supply real estate financial obligation financial investment opportunities.

Green Springs Capital Group Deal With Exclusive Lenders-- Partnering with established loan providers can supply straight access to high-yield financial obligation offers.

Expand Investments-- Spread capital across several tasks to lower risk.

Understand Car Loan Frameworks-- Make certain knowledge of interest rates, payment routines, and borrower credentials before investing.

Screen Market Trends-- Keep educated concerning New york city's real estate conditions to make tactical investment decisions.

Financial obligation investing in New Green Springs Capital Group York realty uses financiers a one-of-a-kind opportunity to produce stable, easy income while decreasing risks Debt investing real estate New York connected with building possession. With numerous financial investment alternatives, from exclusive loaning to mortgage-backed safeties, and accessibility to a vibrant realty market, financiers can strategically grow their profiles while safeguarding regular returns. By comprehending the dangers and best practices, real estate financial debt investing can be a successful and low-maintenance enhancement to any type of investment strategy.

Tia Carrere Then & Now!

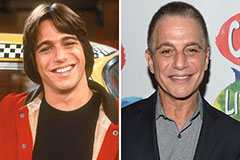

Tia Carrere Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!